Search

Top Stories

Explore the latest updated news!

Stay Connected

Find us on socials

©2024 Copyright All right reserved By Akashera.com

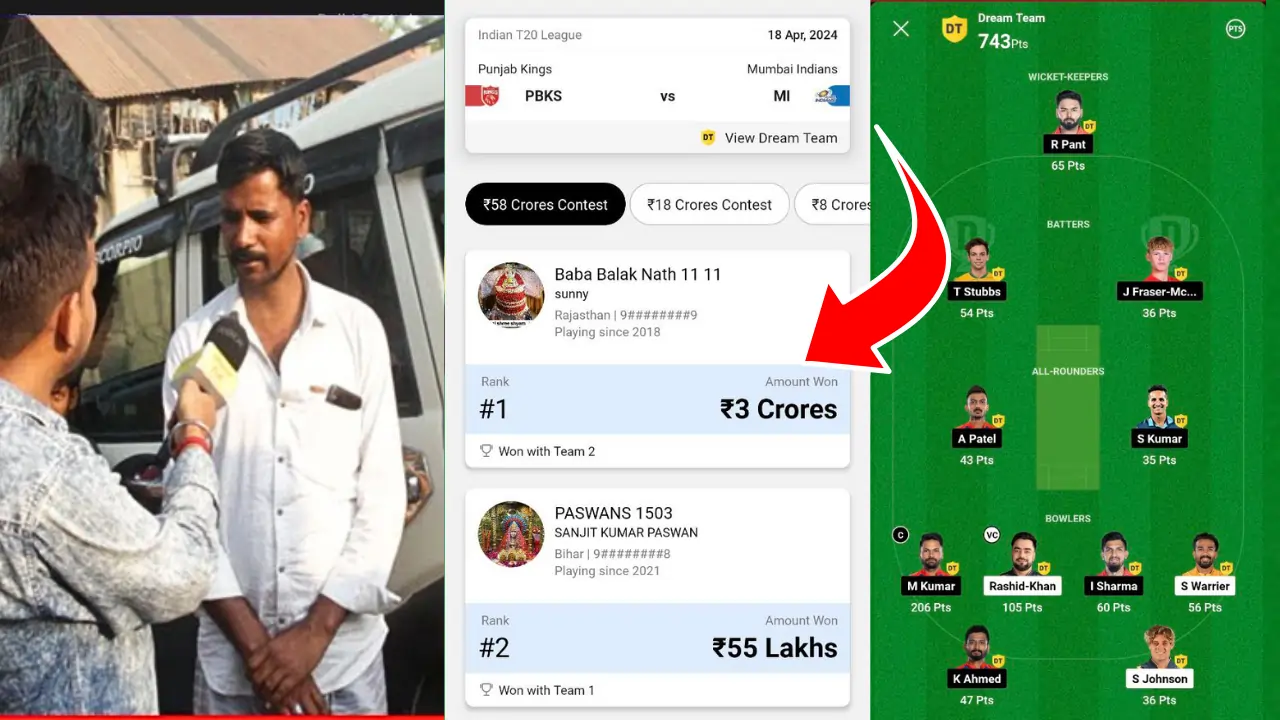

How To Earn with Dream11 : जानिए Dream11 से 1 करोड़ रूपये कमाने का बेहतरीन तरीका

Dream11 से 1 करोड़ रूपये कैसे कमाए (Dream11 se paise kaise kamaye 2024) दोस्तों देशभर में आज कल IPL का सीजन…

अयोध्या राम मंदिर में दर्शन और आरती के लिए ऑनलाइन टिकट बुकिंग 2024

(Free) Ayodhya Ram Mandir Darshan Booking 2024 :अयोध्या राम मंदिर, जिसे भारत के धार्मिक और सांस्कृतिक महत्व का प्रतीक माना जाता…

1

IPL 2024 Orange Cap, Purple Cap List After MI Vs RCB Purple Cap में बड़ा बदला, Points Table में उलटफेर

IPL 2024 Orange Cap, Purple Cap List After MI Vs RCB IPL MI Vs RCB Match Highlights: इंडियन प्रीमियर लीग के…

राम मंदिर प्रसाद ऑनलाइन फ्री बुकिंग लिंक |Ram Mandir Free Prasad Online

भारतीय संस्कृति में प्रसाद एक महत्वपूर्ण भाग है जो धार्मिक और आध्यात्मिक आयोजनों में उपयोग होता है। इसी तरह, भगवान राम…

1

Ayodhya Ram Mandir Darshan Booking 2024, VIP Ticket Price, Aarti Pass Registration

Welcome to Ayodhya Ram Mandir! Are you planning to visit the magnificent Ayodhya Ram Mandir in 2024? Here's everything you need…