Search

Top Stories

Explore the latest updated news!

Stay Connected

Find us on socials

©2024 Copyright All right reserved By Akashera.com

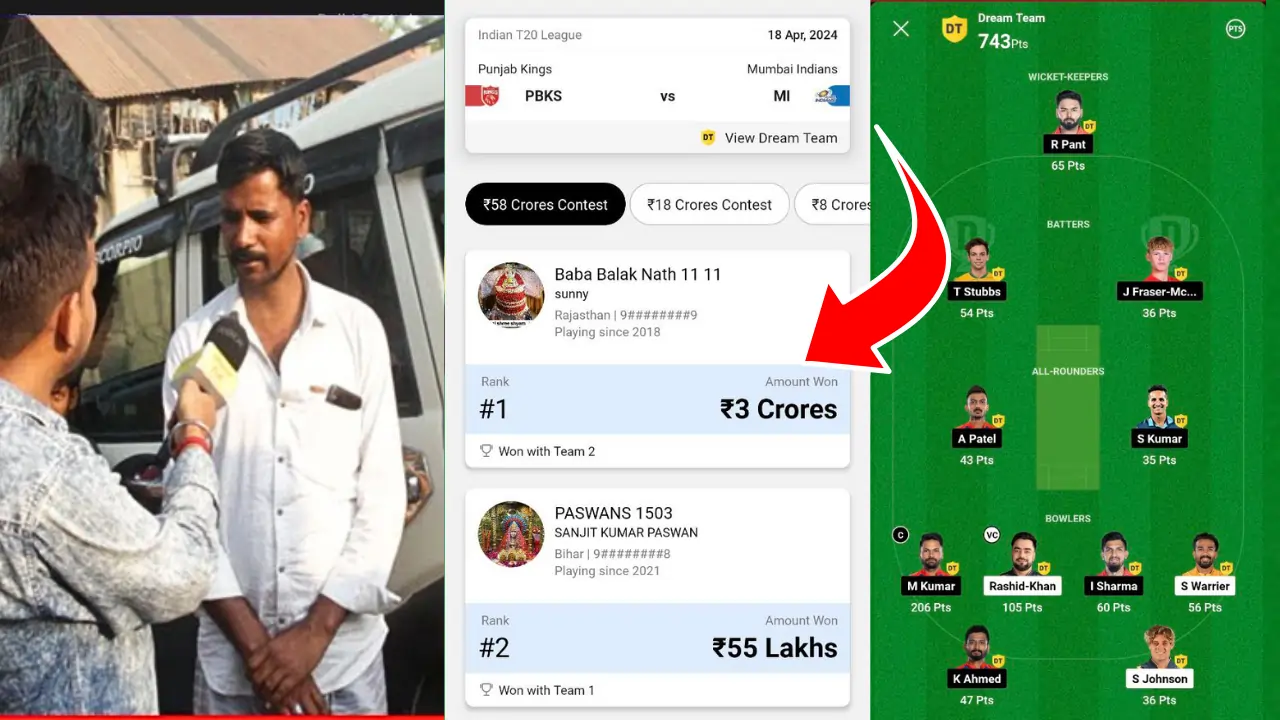

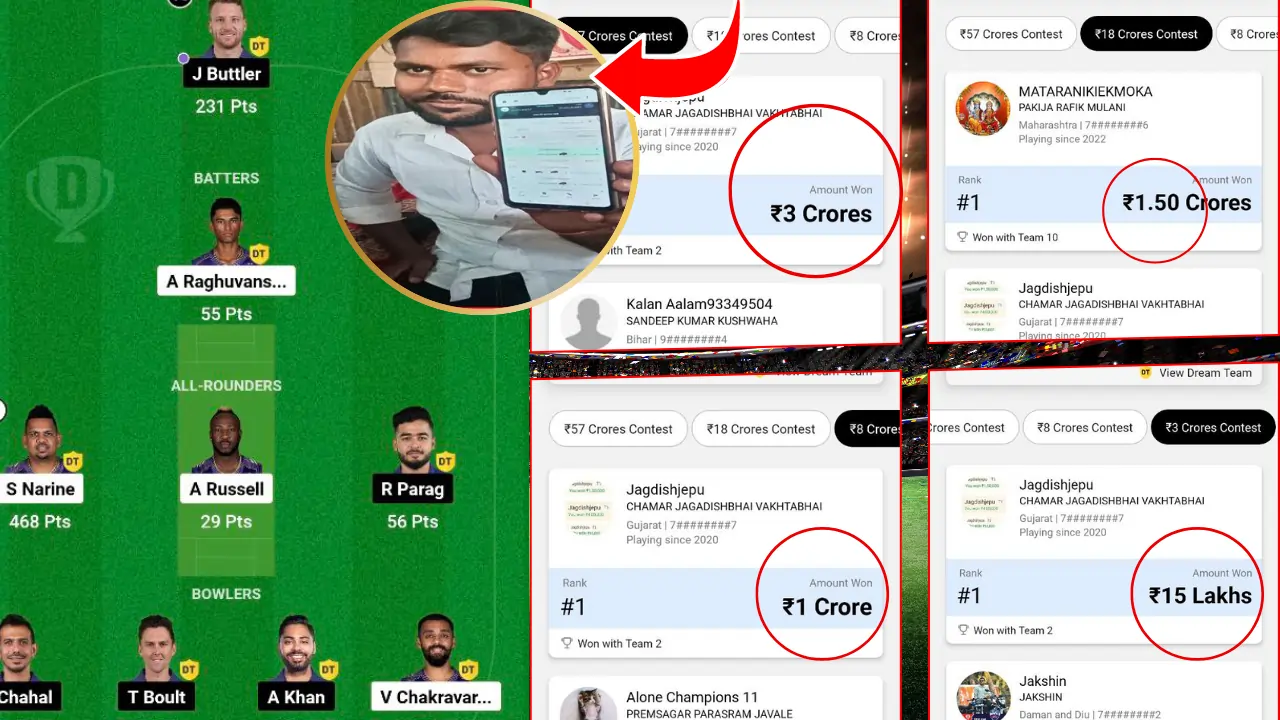

Dream 11 Me First Rank Kaise Laye : इस तरीका से Dream11 पर रोज 1st रैंक आता है, 3 करोड़ रुपए आप जीत सकते हैं, जल्दी देखे

Dream 11 Par 1st Rank Pe Aane Ka tarika : नमस्कार दोस्तों आज इस आर्टिकल में हम आपको बताएंगे कि dream11…

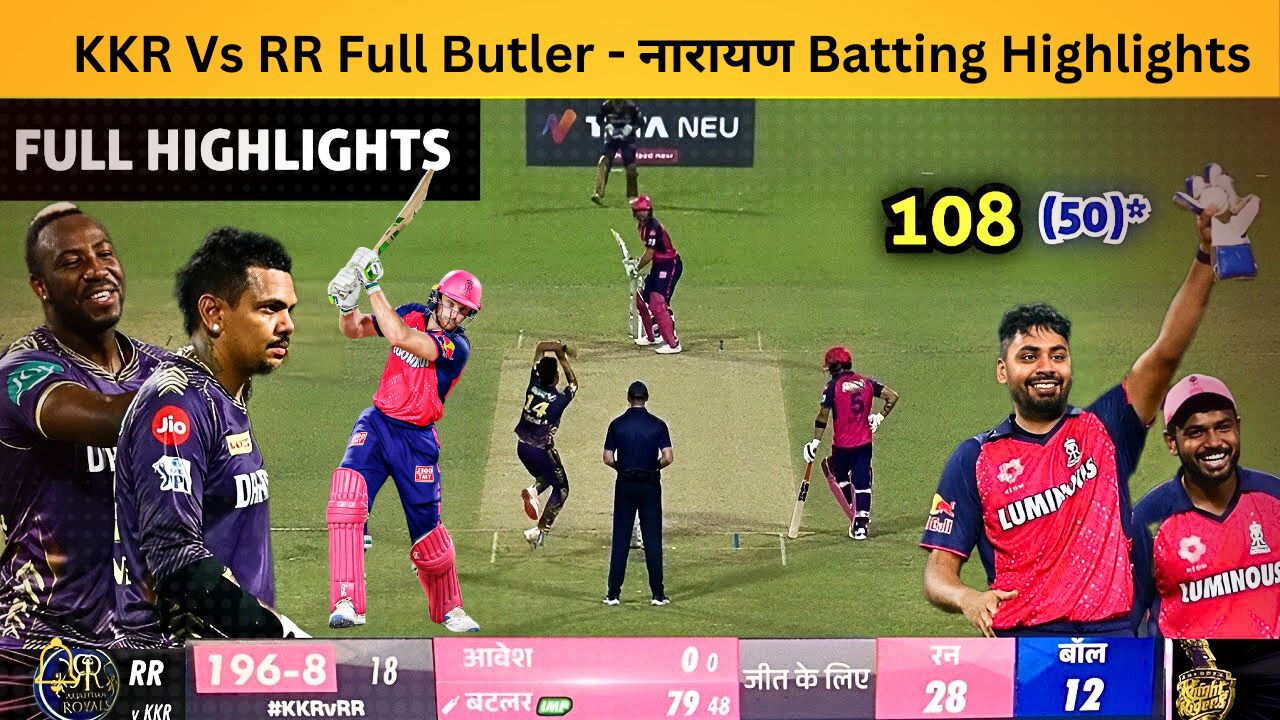

RR Vs MI Pitch Report: आज के लिए ड्रीम11 टीम भविष्यवाणी,पिच रिपोर्ट, प्लेइंग 11,

RR Vs MI Pitch Report: राजस्थान रॉयल्स बनाम मुंबई इंडियंस के बीच आईपीएल 2024 का 38वा मुकाबला आज जयपुर के सवाई…

अयोध्या राम मंदिर में दर्शन और आरती के लिए ऑनलाइन टिकट बुकिंग 2024

(Free) Ayodhya Ram Mandir Darshan Booking 2024 :अयोध्या राम मंदिर, जिसे भारत के धार्मिक और सांस्कृतिक महत्व का प्रतीक माना जाता…

1

राम मंदिर प्रसाद ऑनलाइन फ्री बुकिंग लिंक |Ram Mandir Free Prasad Online

भारतीय संस्कृति में प्रसाद एक महत्वपूर्ण भाग है जो धार्मिक और आध्यात्मिक आयोजनों में उपयोग होता है। इसी तरह, भगवान राम…

1

Ayodhya Ram Mandir Darshan Booking 2024, VIP Ticket Price, Aarti Pass Registration

Welcome to Ayodhya Ram Mandir! Are you planning to visit the magnificent Ayodhya Ram Mandir in 2024? Here's everything you need…